35+ How much will they lend me mortgage

They offer much lower rates than other lenders which saves saves you. 35 29 Dec 20.

Member Spotlight

They can also choose to pass on a.

. Introductory interest rate periods are common across all mortgage types. 35 of prospective home owners are intimidated by the deposit amounts for a property. While your personal savings goals or spending habits can impact your.

Get the right guidance with an attorney by your side. They will discuss your situation and help you find a suitable loan. Mortgage rates close in on 6 highest since 2008 The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie Mac.

This tool has given me the power to plan my payments on my rentals home mortgage and my equity line with the confidence to know exactly how long it will take to pay off my debts and to take control of my finances in a way that makes everything crystal clear. Expenses assets and liabilities you can get an estimate of how much money a bank may lend you to purchase property. Northern Rock formerly the Northern Rock Building Society was a British bankBased at Regent Centre in Newcastle upon Tyne United Kingdom Northern Rock was originally a building societyIt demutualised and became Northern Rock bank in 1997 when it floated on the London Stock Exchange with the ticker symbol NRK.

This looks at how much you make in proportion to how much the mortgage will cost you each month including extras like private mortgage insurance homeowners insurance and property taxes. Factors that impact affordability. Mortgage brokers can help you prepare your application and find the right lender for you 100 free.

Not the needs of a mortgage broker. The front-end ratio is also called the housing-expense ratio. Revolving credit is a more open-ended arrangement allowing purchases to be made on an ongoing basis.

AND YOU TELL ME. In other words there are no surprises for consumers who know exactly what their monthly home mortgage payments and vehicle loan obligations will be. With an interest-only mortgage you just pay the interest during the termYour monthly payment doesnt chip away at your actual debt the amount you borrowed it just covers the cost of borrowing that money.

Use this trick for the entire length of your mortgage and you knock off close to 10 years and save over 66000 in interest. I know it can be tempting to spend your tax refund on something else. In such a case the buyer considers their current location which is often too expensive.

Use this mortgage pay off tip for 10 years and you knock off close to 7 years and save over 54000 in interest. During the early 2000s the company borrowed. Typically lenders cap the mortgage at 28 percent of your monthly income.

At the end of the mortgage term you can choose to pay back the total amount you borrowed in one payment or take out another mortgage. The mortgage should be fully paid off by the end of the full mortgage term. Award winning mortgage lenders.

Storehouse Mortgage kept me informed every step of the way and even sent short videos explaining was was transpiring during each phase. Large national banks exited the reverse mortgage space in 2012 siting difficulties with regulatory environment Dodd-Frank and the inability to create. MONEY AVAILABLE TO LEND.

2347 16 Dec 20. If applicants opt to lend from peer-to-peer lenders loans can get approved within a few. Most payment options include a deposit amount if the purchase if not made at once.

Mortgage calculators can also be handy for calculating the effect of a few small changes to a home loan. They offer a lower rate of interest for the first 2 to 10 years of the mortgage before moving to the lenders standard variable rate SVR. With a capital and interest option you pay off the loan as well as the interest on it.

When it comes to calculating affordability your income debts and down payment are primary factors. Since FHA insures nearly 99 of reverse mortgages available today there is no advantage utilizing a bank to secure a reverse mortgage over a non-bank reverse mortgage lender or mortgage broker. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

With an interest only mortgage you are not actually paying off any of the loan. This was a unique surprise that made me feel comfortable and informed the entire time. At the end of the mortgage term the original loan will still need to be paid back.

So for example when the term for example 25 years is up on a 150000 mortgage you would still owe 150000. Whether you are a first home buyer investor or have been rejected by the bank iLender can help find a solution for you. 6000000 mortgage example at 36 with repayment illustrations over 30 years 25 years and 20 years with shorter mortgage duration examples.

Our network attorneys have an average customer rating of 48 out of 5 stars. They claim that it is quite difficult to come up with the money. Compare the best mortgage deals on a 6000000 Mortgage in 2022.

Member Spotlight

Should You Pay Off Your Mortgage If You Could

Usda Loan Pros And Cons Usda Loan Understanding Mortgages Mortgage

Matt Smith Nmls 418746 Branch Manager Area Ops Manager Gateway Mortgage Linkedin

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

Find Loan Officers Newfed Mortgage

Find Loan Officers Newfed Mortgage

Find Loan Officers Newfed Mortgage

Member Spotlight

Find Loan Officers Newfed Mortgage

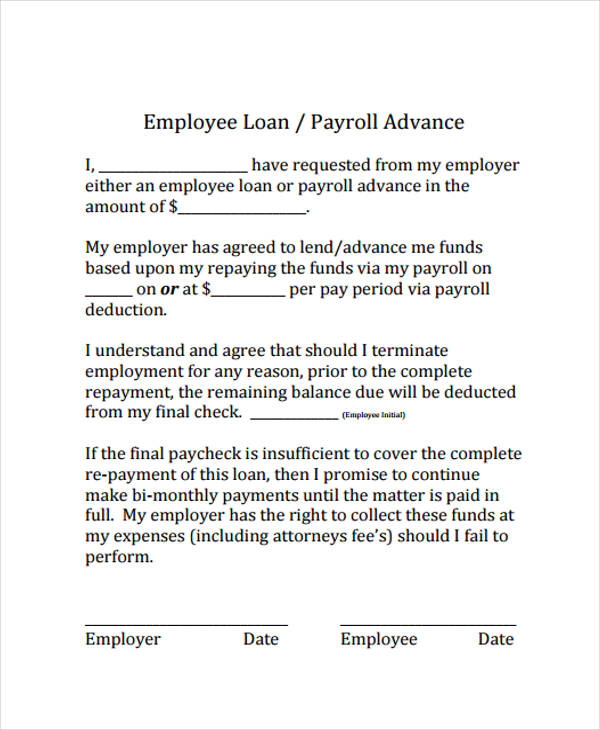

Free 65 Loan Agreement Form Example In Pdf Ms Word

Member Spotlight

Lendlens Com Is For Sale Brandbucket Loan Company Mortgage Brokers Payday Loans

Open Access Loans For Bad Credit Dating Bad Credit

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Member Spotlight

Member Spotlight